Retirement Planning for Your Generation

We presented the complexities of retirement planning in a recent article, highlighting that it is amplified for expats- international professionals living outside their home country. If that is you read on as we present how to address this complexity and set yourself up for the future life you want, specific for your stage in life and your generation group.

Gen Z

Generation Z individuals are the newest entrants to professional life and embracing the opportunities to live outside their home countries. We work with a number of young professionals in this demographic living in Europe who are seeking to make the most of their experience.

For most in the Gen Z group, retirement is a rather abstract and distant concept. When they do get to the other end of their working life, retirement will look very different for them, than it does for the Baby Boomers entering retirement now.

It is so far away that many in this young demographic can be forgiven for thinking it is not important and that they can forget about it and pick it up again in 10 or 15 years. This however is a wasted opportunity.

Planning for retirement does not necessarily mean having to lock your money away forever. With this younger group that we work with, we encourage a balance between current lifestyle and preparation for the future. You don’t necessarily have to forgo liquidity, and can weigh up how you invest for your future. Flexibility can be important for such a long time frame and for many this should be built in.

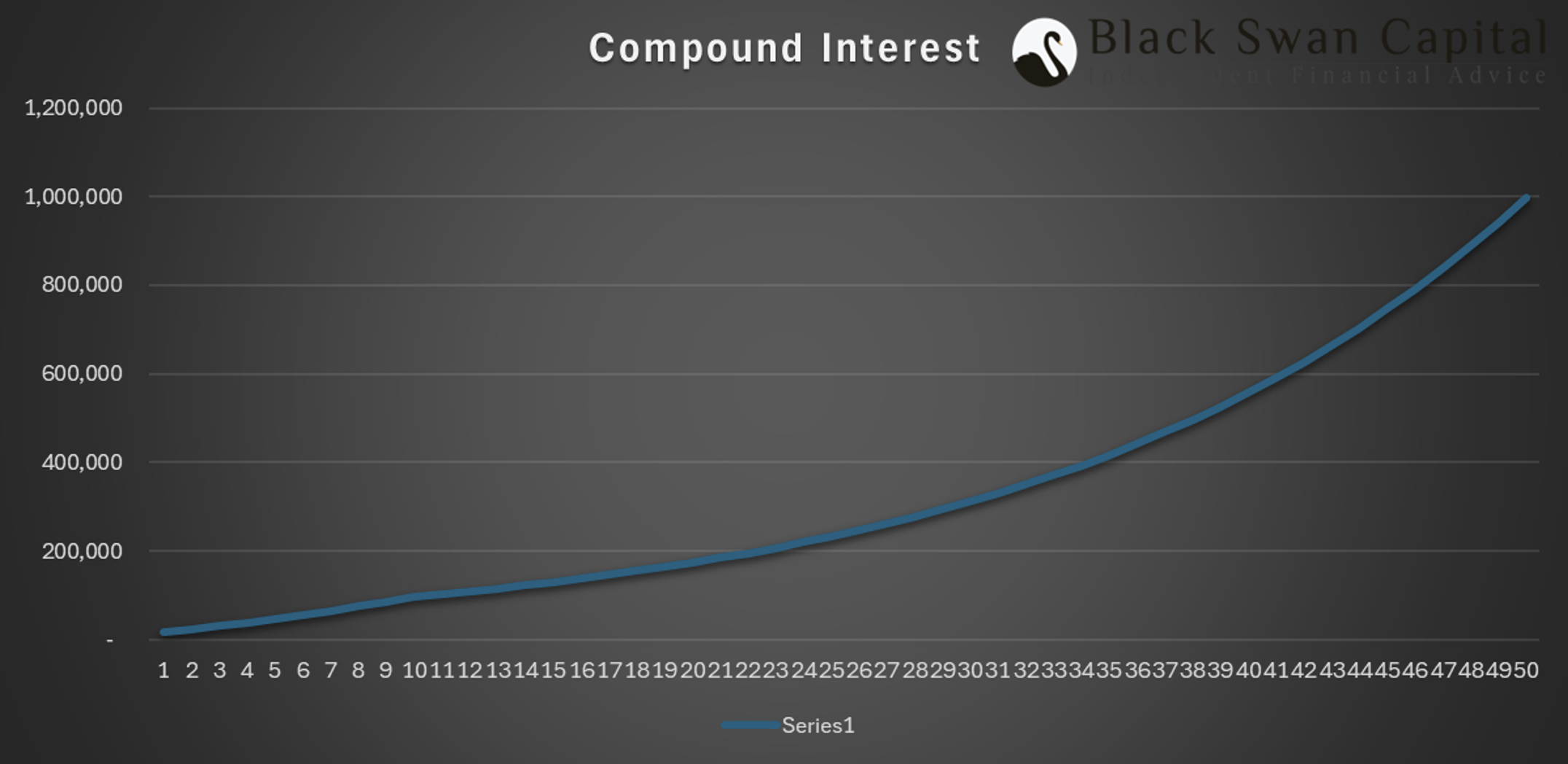

The great opportunity Gen Z has is taking full advantage of compound interest. The nature of compounding growth is that it lends towards the exponential. Here is a great example of this below.

In this graph a person invests €10,000 and adds €500 per month for ten years and then does nothing! After that they let it stay invested and compound. It shows that if you invest for ten years in this manner you might expect this to grow to €97,000. This is like commencing retirement planning in your 50s.

If you give it an extra ten years to sit and compound, which means ten years of adding to the investment and ten years of it growing with no additions, it could grow to €173,000. Another ten years, letting it run for 30 years, and it could be worth €325,000.

And here is the kicker, by starting this in your 20s, adding to an investment for ten years and then letting it sit there and compound and grow, by the time you are in your seventies, after 50 years, it could grow to around €1,000,000! That is the power of compound interest, getting a big return for a small input, by harnessing time. For those interested in the details I have presumed a 6% per annum return, reinvested.

For Gen Z and to a lesser extent Millennials below, take advantage of time and make it work for you.

Millennials

This large demographic of people born between 1981 and 1996 are becoming predominant in the workforce. If you are in this group you may be accelerating your career growth and earning potential. As your income grows, for many it is when expenses will also creep up, especially if you have a young family. Cash flow management is vital.

If you are a millennial living as an expat in Europe, the biggest potential risk is missing out on the compounding growth benefits of pensions, that you might otherwise receive in your home country. It is paramount therefore that you get financial planning advice to address this. It can be difficult with cash flow pressures to ensure you are contributing to your long term future- it is in the important but not urgent quadrant- but you don’t want to wait until it becomes urgent and important/ almost too late.

We work with many millennials helping to secure their future without sacrificing their quality of life today.

Millennials are also in the workplace reality first experienced by the generation that went before them, the Gen X group, when workplace security evaporated. It is prudent for Millennials (and for you Gen Xers) to be mindful that your career and earning capacity may be shorter than you want. You may have a plan on working until you are 65 but may find yourself redundant at 52. You need to address this by ensuring you are investing for the future now, and by having career and lifestyle contingencies. Think well ahead of time about what your next career might look like. It could be a back up career or it could be a dream realisation or passion project.

Millennials are in the thick of it with ageing parents, young children, and work pressures but at the age of professional credibility and earning potential. It is a great time to set yourself up for the rest of your life. Leverage and make sure you don’t miss out on pensions and think self-sufficient when it comes to your future. Speak with us and we can help you achieve this.

Gen X

For those seeking early retirement, you might be just about there and for the rest of the cohort that forms this demographic, you are at the age where pensions feel increasingly real: relevant and important.

What is most important for Gen-Xers is to revisit your objectives. Spend some time thinking about the big picture. This is important for every generation but it is at this stage that your goals start to solidify. Consider what retirement means for you- where and how you want to live, how you plan to fill your days, when you want to stop working, whether you want to keep working and gradually transition to retirement, what will drive and fulfil you. Know your goals. Without a goal you will never know if you are on track, or even on the right track. You will also never know if you have reached your target.

With a clear goal you can direct your financial planning towards the right solutions. Whatever format you utilise, whether it is pensions, investments, property, other asset classes, they are all just the tools employed to help you achieve your goals. A good plan will direct you to deploy the right tools for you.

The focus is then on optimising your returns, building an asset from which you can supplement your income to maintain the quality of life you desire for the rest of your life. How you construct your investment portfolio is important and active management with good advice to ensure you remain on track and aligned, especially through periods of change in the economic cycle and times of enhanced volatility. These are the periods when good advice can add the most value to you.

Gen X need to actively manage the risk return profile over time. As you get closer to your target retirement date, consideration needs to be given to the portfolio makeup potentially altering asset class mix and evolving the focus from maximising capital growth to securing the gains already achieved and delivering consistent income. It is a dynamic period that can really benefit from close and personalised financial advice.

Baby Boomer

Are you a boomer? You may well be close to or even in retirement.

Those that fall into the baby boomer demographic are probably the most well supported with pension structures and proportionately may receive more income from their pensions than younger demographics, but you will still probably need to supplement this with other income generated from your investments and savings.

At this stage the important focus areas are:

Understand your cash flow and re-designing how you spend your money to align it to what it most important in your life.

Tracking and making optimal use of your pensions wherever they may be in the world. The age which you can access pensions is different in different countries and can vary by up to 15 years. Look back at where you have lived and make sure you are not overlooking an income pot that you have earned and built up.

Asset management and portfolio composition will have to adjust when you begin to draw an income from your pension and investment assets. Ongoing financial advice is critical and can have a notable impact on your quality of life and the longevity of your income generating assets. We recommend you seek professional advice from a firm like Black Swan Capital.

Future planning is complex. We are living in a fast paced and changing world where we can expect retirement in the future will look very different from today. It is beholden on us therefore to make sure we are prepared, to have contingencies in place, to start planning early and to build in flexibility so you can adapt and stay on track. Speak with us at Black Swan Capital whatever your stag and we can put together a comprehensive plan specific to your unique situation.